Finding the best investment options can be tough in today’s ever-changing economy. Luckily, Pakistan has a booming economy with plenty of opportunities for people who want to make their money grow. In this blog, we’ll explore some of the best return on investment options in Pakistan. From traditional options like real estate and gold to newer ones like 3D printing and forex trading, we’ll cover a range of options that can help you earn high return on your investment.

By learning about these different investment options, you can make smarter choices based on your goals and how much risk you’re comfortable with. So, let’s discover the investment options that can help you make the most of your money in Pakistan. Whether you want long-term growth, steady income, or the chance for big rewards, there’s something for everyone in this exciting market.

Investing in Real Estate

Investing in real estate is a popular choice for individuals seeking long-term profit. Pakistan’s real estate sector has witnessed significant growth in recent years, particularly in major cities like Karachi, Lahore, and Islamabad. Investing in real estate can provide substantial returns over time with the increasing demand for residential and commercial properties.

There are many types of real estate investments in Pakistan that are highly profitable, including:

- Buying property files.

- Purchasing plots for resale.

- Renting out properties.

- Investing in open land for future development.

There are several reasons why real estate investment in Pakistan is rewarding:

- Renting out a property can bring in rental income from the first month. Tenants may even pay advance rent for several months, ensuring quick returns.

- A tenancy agreement allows for a steady flow of rental income over a certain period, whether monthly, bi-annually, or annually.

- Properties generally retain their value and may even appreciate over time if well-maintained.

- Real estate investments offer greater control and lower risk than other investment options. This makes it suitable for beginners and small-scale investors.

If you’re interested in exploring real estate investment opportunities in Islamabad, we would like to present two exceptional projects: “The Oriental Centre” and “Diamond Excellency,” located in Bahria town, Islamabad. These projects offer unique and compelling advantages for investors looking to invest in real estate.

Gold

Investing in Gold has always been considered a safe investment. Pakistan has a strong affinity for gold, making it an attractive option for investors. The price of gold usually goes up when there is economic uncertainty, which makes it more valuable.

If you’re considering investing in gold, it’s best to avoid buying gold jewelry. Dealers often add a “making fee” to the price, which can be as much as 10-15% of the gold’s value. This extra cost is unnecessary and reduces the potential benefits of gold as an investment. Instead, buy gold bars and coins. It is considered a safe asset and has been used for investment and trading since ancient times.

Stock Trading

Investing in the stock involves buying shares or stocks of companies expecting to earn a profit. It can be attractive for individuals looking to grow their wealth over time. However, successful investing requires careful research and analysis. In Pakistan, the Pakistan Stock Exchange (PSX) serves as the primary platform for buying and selling stocks. The PSX provides investment opportunities across various sectors, including manufacturing, technology, finance, and energy.

To maximize returns, investors should focus on selecting fundamentally strong companies. These companies have solid financials, stable growth prospects, and a competitive edge in their respective industries. Conducting thorough research on a company’s financial performance, management team, and market position is crucial before making investment decisions.

It’s essential to note that investing in the stock market involves risks, as stock prices can fluctuate and result in losses. Therefore, it is advisable to consult with financial advisors or professionals and only invest money you can afford to lose.

Savings Accounts

Savings accounts are an easy and safe way to invest money for people who don’t want to take risks. In Pakistan, banks offer savings accounts with competitive interest rates. This means that if you put your money in a savings account, you can earn some extra money over time. Savings accounts are good for short-term goals or saving money in emergencies. They are also easy to access, so you can get your money whenever needed.

One of the advantages of having a savings account is that it provides a sense of security. Unlike riskier investments like stocks or real estate, savings accounts are protected by deposit insurance, which means that even if the bank faces financial difficulties, your savings up to a certain limit are guaranteed to be safe.

Personal Skills

Investing in personal skills and knowledge is invaluable and can lead to long-term career growth and financial stability. Enhancing your skills through education, certifications, or vocational training can open doors to better job opportunities, promotions, or entrepreneurship. Investing in yourself provides personal fulfillment and increases your earning potential and overall financial well-being.

Forex Trading

Forex trading is buying and selling foreign currencies to profit from fluctuations in exchange rates. The forex market in Pakistan has gained popularity among individuals interested in online trading. With the right knowledge and skills, forex trading can provide substantial returns.

When you engage in forex trading, it’s important to understand how the market works and possess the necessary skills to make informed trading decisions. If you approach it with the right knowledge and expertise, forex trading has the potential to generate significant returns.

However, it’s crucial to acknowledge that forex trading has risks. The forex exchange market is highly volatile and can experience rapid fluctuations, leading to financial losses if trades are not executed wisely. Therefore, it is essential to implement proper risk management strategies to protect your investments and minimize potential losses.

To be successful in forex trading, continuous learning is key. Staying updated with market trends, economic indicators, and global events that impact currency values can help you make more informed trading decisions. Additionally, refining your trading skills and strategies through practice and analysis can enhance your chances of achieving consistent profitability.

Bonds

Investing in government-issued bonds can be a relatively low-risk option for conservative investors. Pakistan offers various types of bonds, such as Treasury Bills and Pakistan Investment Bonds (PIBs), which provide fixed interest payments over a specified period. Bonds offer a predictable income stream and can be a suitable investment for individuals seeking stability and regular cash flows.

Prize bonds are another type of investment instrument issued by the government of Pakistan. They are a form of lottery where investors purchase bonds with specific denominations. These bonds enter into periodic prize draws, and bondholders can win cash prizes through these draws.

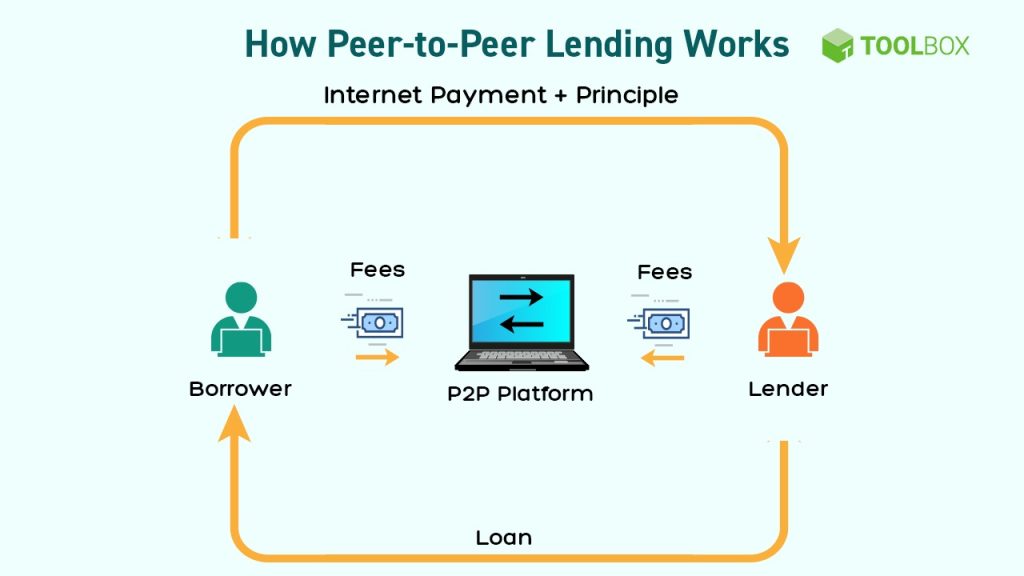

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms have become an alternative investment option in Pakistan. P2P lending allows individuals to lend money directly to borrowers, eliminating the need for traditional financial institutions. This investment avenue offers higher interest rates compared to conventional savings accounts and provides an opportunity to diversify one’s investment portfolio.

However, it is also riskier than traditional investments. Lending money to trustworthy people or companies is a good idea to lower this risk. By carefully choosing borrowers you trust, you increase the chances of getting your money back and minimize potential losses. This way, you can enjoy the benefits of peer-to-peer lending while protecting your money. Before you invest, it’s important to thoroughly check the borrower’s financial history, creditworthiness, and reputation on the lending platform. These checks reduce the risks and make your lending portfolio more secure and reliable.

3D Printing

With technological advancements, 3D printing has emerged as an innovative investment option. Pakistan has witnessed a rise in 3D printing startups, offering opportunities for investors to tap into this growing industry. From manufacturing to healthcare and construction, 3D printing can revolutionize various sectors, making it an intriguing option for those looking for long-term growth potential.

Saving Certificates

The Pakistani government provides saving certificates called National Savings Certificates and Defense Savings Certificates. These certificates are a safe and dependable way to invest your money. They offer fixed interest rates and come with different lengths of time before you can access your money, which makes them good for people who want steady profits.

National Savings Certificates and Defense Savings Certificates are investment options offered by the government of Pakistan. They are considered safe and reliable because the government backs them. These certificates provide a fixed interest rate, meaning you will earn a predetermined amount on your investment. They also have different maturity periods, determining when to withdraw your invested funds. This flexibility allows individuals to choose the certificate that aligns with their financial goals and timeframes. Whether you want a shorter or longer investment period, these certificates provide options for stable returns.

Conclusion

When considering investment options in Pakistan, assessing your financial goals and risk tolerance is essential. Diversification across different investment avenues can help mitigate risks and maximize returns. From traditional options like real estate and gold to modern choices like 3D printing and forex trading, Pakistan offers various investment opportunities to suit various investor preferences. Remember to conduct thorough research, seek professional advice if needed, and stay updated with market trends to make informed investment decisions.